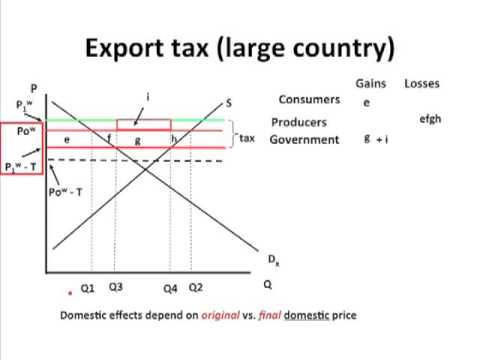

We've already taken a look at a small country export tax. We identified the goals of reducing the domestic price and the potential interest of government earning revenue. We also noted the downsides of hurting domestic producers who could otherwise export profitably to the international market. However, there are other motivations for a large country that are quite distinct from the effects of the small country case. Most importantly, a large country can restrict the amount of exports that go into the international market, forcing the international price up. So, there's a possibility that an export tax could actually be beneficial to a domestic economy, mainly because of taking advantage of its market power in global markets. This is very similar in general effects, but the big difference is that there is a difference of effect on the world price. Now, let's imagine the same policy as for the small country. Again, for concreteness, let's say the world price is a hundred. We put a tax on of ten dollars. So, initially, the domestic price and the amount that domestic producers get from selling abroad fall by ten dollars (the export tax). But, as a large country, this has an impact on the international market. The reduction in the exports of this product will result in a significant fall in the supply of this product on international markets. That is going to affect the international markets and raise the price in the world economy, which we depict as p1. Now, how much p1 increases depends on the supply and demand elasticity of this product in the international market. All we know is that the world price will rise. The price that domestic consumers and producers finally receive will be reduced by the same tax rate. So, we now have the new...

Award-winning PDF software

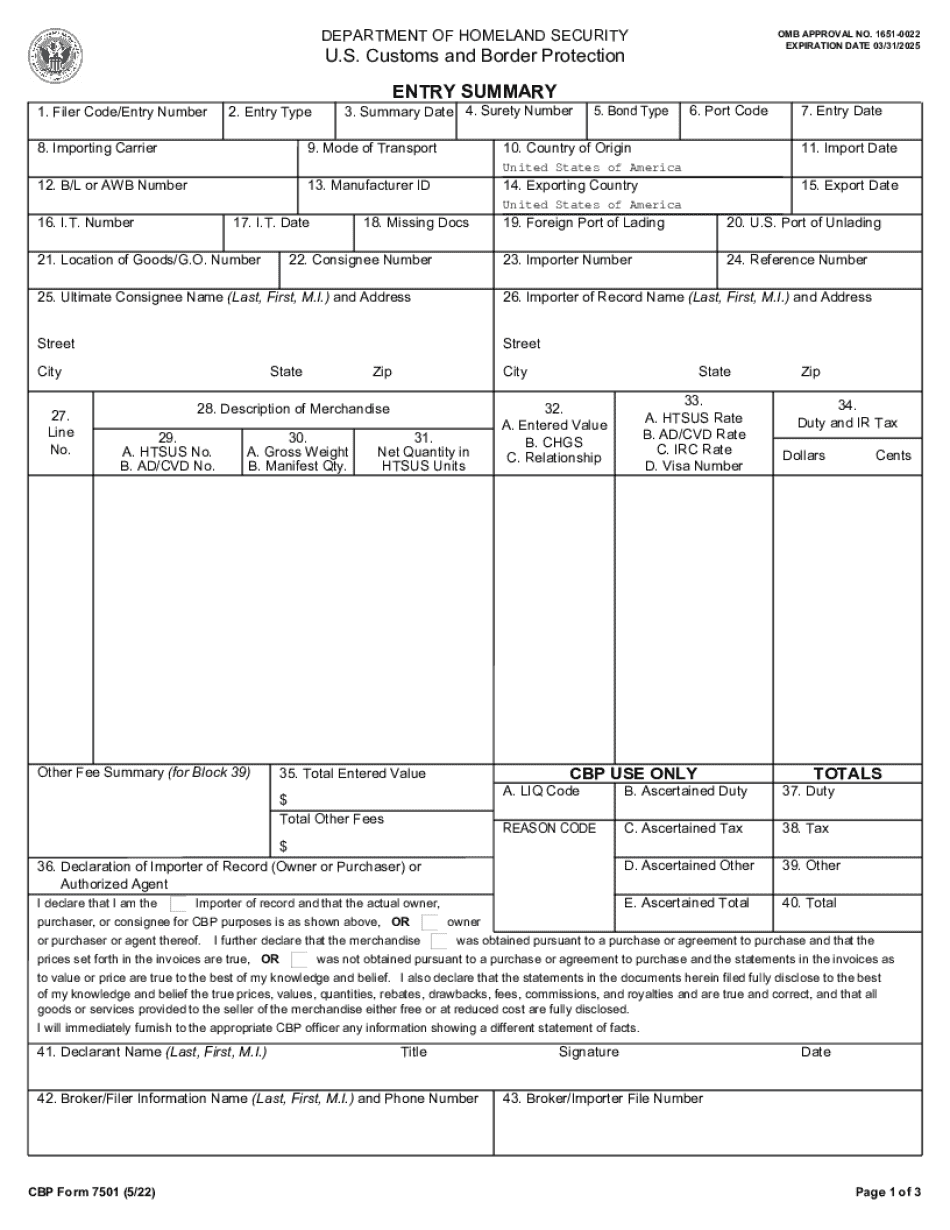

Country of export on 7501 Form: What You Should Know

When goods are returned from export to a foreign country, code returns the previous country code, as shown in the following diagram. [13] [14] Citing Customs Docket Entry, P.O. Box 1082, San Antonio, TX 78216, April 14, 2012. The CBP Form 7501 (13) refers to the CBP Customs Docket Entry, P.O. Box 1082, San Antonio, TX 78216. When the Customs Docket Entry of P.O. Box 1082 on the CBP Form 7501 (13) is used, a country or countries listed below will be listed on the form: India; Japan; Hong Kong; South Korea; Singapore; China; Taiwan; Macau; and Hong Kong SAR. [15] See § 30.3(a)(1) –(5). [16] United States Department of State Bureau of Consular Affairs. 2012. Duty to Report to U.S. Consular Officer on Deposits of Cuban Cigars at United States Embassies, High Commissions, Consulates, and Missions to U.S. in Foreign Countries. Available at (accessed August 29, 2014). E.T.A.P. : consular Affairs Professionals The E.T.A.P. is the Department of State's internal group that provides personnel, support, and training to U.S. Department of State Embassies abroad. The E.T.A.P. offers services and expertise on a wide range of policy, programming, management, and consular matters and related issues that address the work of U.S. Embassies overseas. The E.T.A.P. Office is not responsible for any information contained in this publication. If any errors are found in this section, please contact the relevant E.T.A.P. office using the email provided below: E.T.A.P. Office: Embassy-American Trade Promotion Policy E.T.A.P.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Cbp Form 7501, steer clear of blunders along with furnish it in a timely manner:

How to complete any Cbp Form 7501 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Cbp Form 7501 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Cbp Form 7501 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Country of export on 7501