Award-winning PDF software

Cbp_form_7501.pdf - mva

OR EMPLOYEE). TITLE. 42. EXHIBIT A. Title. 43. EXHIBIT B. Title. 44. Filed Document Number. 45. Title (, Certificate of Registration, Receipts, etc.) 44. Description (, Certificate Of Registration, Owner, etc.) 45. Date. 46. Filer's Name. Filler's Name. 47. Description (Telephone number, address, etc.) 48. Description (Certificate Of Resistibility, Title, etc.) 49. Date. 50. Filer's Address (, street address, city, state, zip code, etc.) 51. Title (, corporation or limited partnership) 52. Location (, branch, office, warehouse, warehouse location, etc.) 53. Owner Name, Office, Address (, the owner of the vehicle.) 54. Owner's Name (, the owner's name of the business or nonprofit) 55. Type Of Business (, commercial vehicle, construction, repair, etc.) 56. Business Name (, dealership, auto dealer, motor vehicle dealer, etc.) 57. Street Address (, the address of the business) 58. City of The United States (, New York City, the state of California, and the.

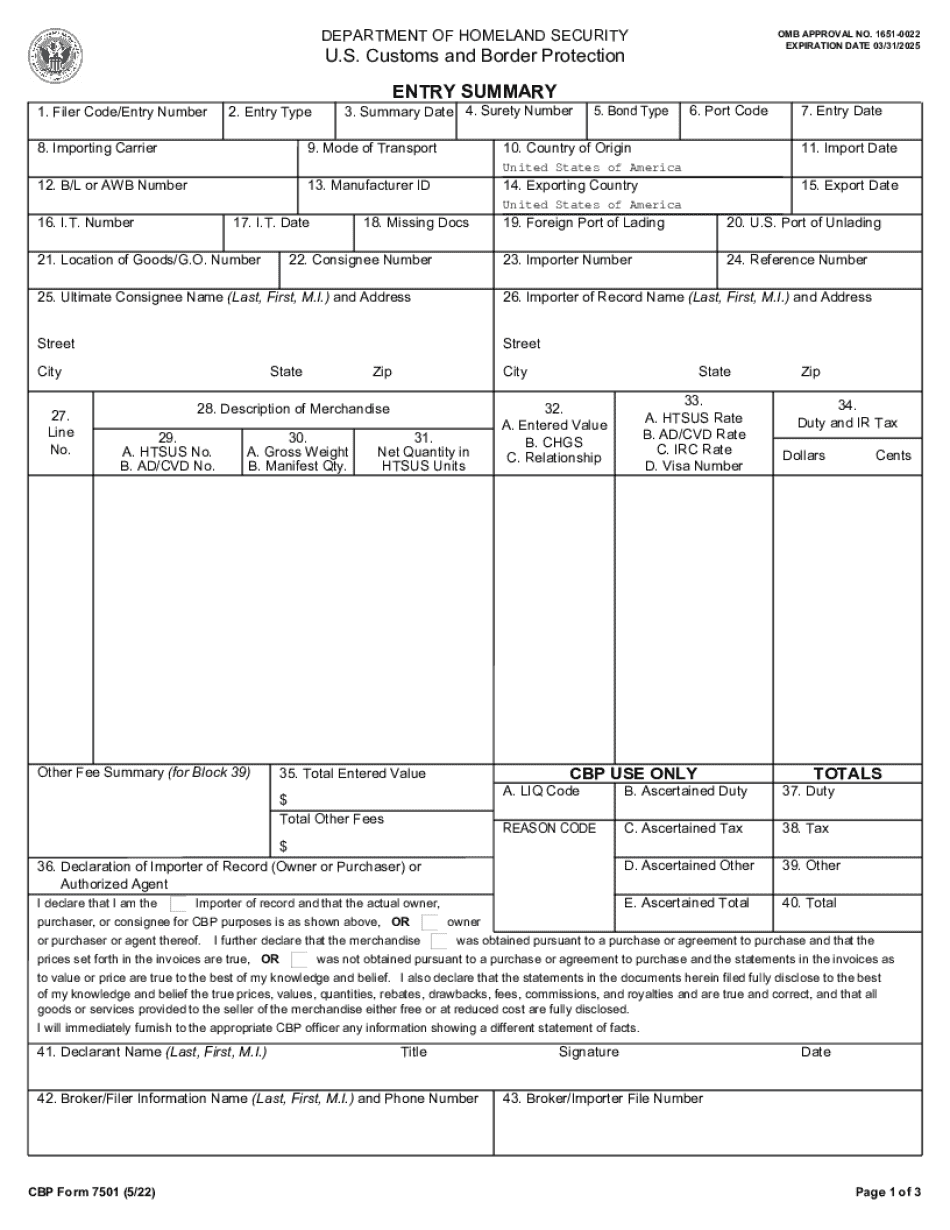

Cbp form 7501 entry summary - a vital import document for

CBP data “ on entering undocumented migrants at ports of entry. In essence, it is a data entry summary that summarizes a traveler's information, and it can be used to see and identify if a person is an illegal alien. The Form 7501 contains a box titled”Information for the Entry Summary,” as well as other boxes for the entry summary of any individual, or the entries that may have been made with an illegal alien. CBP Form 7501 Form 7501: Entry Summary Information Form 7501 does not identify individuals; rather, it identifies all legal entries by, any illegal alien, or any entry on a temporary and/or conditional resident immigrant. To obtain the Entry Summary for a particular entry, CBP uses the “information for the entry summary section in the border/cargo/travesty section of the CBP Form 7501” (see Box #3 in the image below.) Box #3 of.

19 cfr § 143.24 - preparation of customs form 7501 and

Pub. L. No. 114–113, §601(a)(1), (2), 129 Stat. 2385, 2393. (This text was derived from the section in the version published as part of the “Codification of 2001 Amendment [sic),” published October 27, 2002, 73 7258, which was substantially renumbered section 806 of title 4, Transportation.) Amendment of section effective not later than six months after date of enactment. §811. Imposition of tax based upon duty or fee assessed as violation of section. Any person who has failed by willful evasion, evasion of lawful payment, or fraud, to pay the amount required to be collected from him under this part shall be subject to a penalty of 1,000, upon the payment of which the Commissioner of Internal Revenue may assess to the person the amount of tax in the manner set forth in section 6110(a)(2), and such tax must be paid in the manner provided by subchapter U of chapter.